Following the full implementation of the DDP (Delivered Duty Paid) regulation for U.S. orders on eBay Korea starting October 17, 2025, the cross-border e-commerce industry faces dual challenges in compliance and growth. Sellers must now cover tariffs, import taxes, and customs clearance fees, while also submitting clear English tax documentation strictly compliant with U.S. IRS and CBP standards. Product listings must accurately display UL certification numbers, RoHS compliance, and voltage compatibility ranges. Additionally, sellers must efficiently allocate traffic across multiple platforms to avoid declining conversion rates caused by data fragmentation. For many small and medium-sized Korean sellers, the transition from mere survival to sustainable growth is no longer optional—it has become a critical hurdle.

The first major casualty was Seoul-based 3C accessories seller Kim, whose experience serves as a cautionary tale. In August 2025, his store received a $200,000 U.S. order, but due to HS code mismatches between the actual product category and those generated by a non-professional translation tool in the tax documents, U.S. Customs deemed the declaration inaccurate. The shipment was detained, accruing warehouse fees of $800 per day. Furthermore, the listing incorrectly translated "power adapter" as "charger," failed to include UL certification numbers or voltage specifications, resulting in platform warnings, a sharp drop in ratings, and near account suspension. To offset DDP-related costs, he hastily expanded to Amazon and Wish, among three other platforms, only to fall into the trap of fragmented traffic management. His advertising ROI plummeted from the top-seller benchmark of 1:3.5 to 1:1.8, with high-quality traffic dispersed across channels.

According to eBay Korea’s data, 62% of TP3T violations stemmed from incorrect tax information, with 38% specifically attributed to HS code-category mismatches. Meanwhile, 75% of TP3T small and medium sellers lacked unified traffic analytics, preventing precise ad targeting—resulting in up to a 4.2x gap in campaign ROI. Behind these cold statistics lie countless stories of seller anxiety and frustration after fruitless efforts.

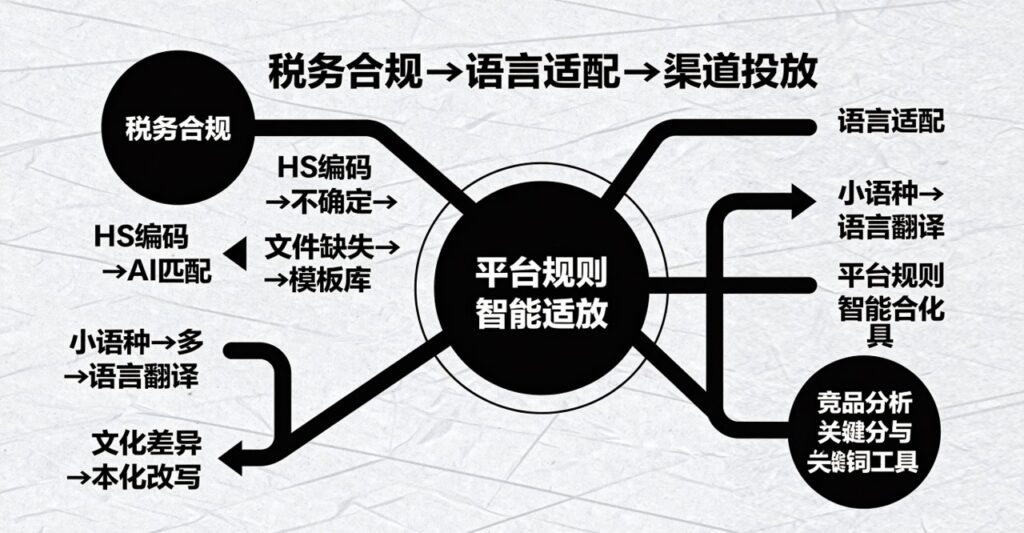

The solution lies in deep AI-powered empowerment. First, an **Intelligent Tax & Finance Translation Engine** enables "term-level" compliance in documentation. Integrated with the latest customs and IRS policy databases, this engine accurately interprets HS codes and automatically generates standardized English tax documents—including UN hazardous goods declarations, updated tariff rates, and maritime shipping requirements—reducing declaration error rates to just 0.3%, and cutting traditional 8-hour manual processing time down to 45 minutes. Its self-updating policy database ensures sellers remain continuously compliant.

Second, the **AI Localization Marketing Assistant** goes beyond literal translation, balancing compliance with conversion optimization. By incorporating American linguistic conventions and consumer search trends, it transforms phrases like "quality guarantee" into "Lifetime Warranty," automatically inserts UL certification numbers and voltage compatibility details, and strategically highlights key product advantages within copy. One outdoor gear seller using this technology saw a 23% increase in listing click-through rate, a 15% decrease in bounce rate, and a 12% reduction in return rate—achieving seamless integration of compliance and marketing effectiveness.

Third, the **Cross-Platform Intelligent Advertising System** dynamically allocates budgets based on historical conversion data and seasonal peaks. Seven days before Black Friday, it prioritizes heavy investment in 3C categories on eBay U.S.; during Prime Day, it precisely targets high-conversion keywords, and continuously adjusts CPC bids and audience targeting in real time based on each platform's ROI performance. This system helped Korean sellers improve their advertising ROI from 1:2.1 to 1:3.8, achieving true synergy between brand visibility and sales performance.

These solutions have been integrated by LnRu’s overseas division into a one-stop AI compliance and advertising platform: sellers need only upload product information to receive standardized tax filing documents, auto-localized content, and customized advertising strategies—eliminating tedious manual processes entirely. In real-world cases, one 3C seller increased compliance approval rates from 68% to 99%, improved tax filing efficiency tenfold, achieved a 30% monthly sales growth, reduced advertising costs by 17%, and secured stable profitability across multiple platforms.

In today’s environment of rising global compliance standards, DDP is no longer an excuse for retreat, but rather a “filter” accelerating market consolidation. Only sellers equipped with robust compliance controls and intelligent traffic operations can achieve sustainable growth in Western markets. Leveraging forward-looking technology and localized service expertise, LnRu empowers small and medium sellers with seamless AI-driven solutions for compliant translation, localized marketing, and intelligent channel advertising—enabling transformation in international expansion and turning DDP regulations into a growth accelerator, not a burden.