In cross-border trade across Southeast Asia, traditional payment methods such as bank wire transfers and conventional third-party payment platforms have become core obstacles for enterprises expanding overseas. High currency conversion losses, prolonged settlement cycles, frequent hidden fees, and cumbersome compliance procedures severely constrain corporate capital efficiency and profit margins. Particularly against the backdrop of the pandemic accelerating the adoption of e-wallets, traditional fund transfer models are increasingly outdated. To address these pain points, Feimautong has launched a competitive localized payment collection solution that effectively overcomes the bottlenecks of traditional cross-border payment collection.

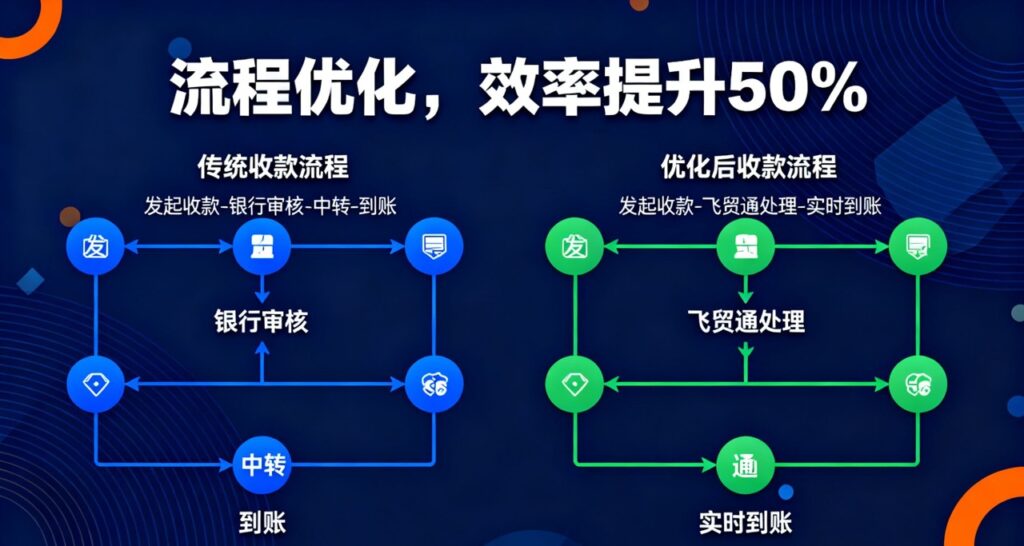

By establishing local bank accounts in six Southeast Asian countries—including Malaysia, Vietnam, and the Philippines—Feimautong enables direct receipt of local currencies, eliminating multiple layers of foreign exchange conversion losses. This innovative account structure significantly streamlines cross-border clearing processes and removes the margin erosion caused by currency conversion. Furthermore, supported by an optimized global remittance network, Feimautong offers 7×24 real-time settlement, drastically reducing fund transfer time and greatly enhancing supply chain capital turnover efficiency. For example, Vietnamese electronics sellers using the service can receive payments within just 3 seconds—compared to the traditional 3–7 business days—resulting in over a 50% improvement in capital utilization efficiency.

Exchange rate risk management is another key advantage of Feimautong. Through real-time exchange rate locking technology, businesses can fix exchange rates at the moment of transaction, avoiding profit loss due to currency fluctuations. In Southeast Asia’s highly volatile foreign exchange markets, this real-time hedging mechanism significantly strengthens enterprise risk management capabilities and ensures more stable profitability. Overall, the Feimautong solution reduces total cross-border payment costs by approximately 40% compared to traditional methods, transforming cross-border fund flows from a "pain point" into a strategic "competitive advantage" for market expansion.

Beyond cost reduction and accelerated fund circulation, Feimautong also ensures compliance and financial security. Its operations strictly adhere to local financial regulations, including those enforced by Indonesia’s OJK and Malaysia’s BNM, guaranteeing legal and compliant fund handling. For small and medium-sized cross-border merchants reliant on rapid capital turnover, this localized collection method is not merely a payment channel but a critical enabler of enhanced market competitiveness.

Additionally, Feimautong complements the LnRu platform by integrating AI-powered translation and multi-channel marketing tools, forming a closed-loop cross-border service ecosystem covering payment collection to operational support. This ecosystem allows businesses to improve capital efficiency while simultaneously expanding their local customer base in Southeast Asia through precise multilingual marketing—achieving dual growth in "payment collection + customer acquisition." This deeply integrated model of "digitalization + localization" significantly enhances the overall operational capability and market responsiveness of overseas enterprises.

Looking ahead, cross-border payment collection in Southeast Asia will continue to evolve through the convergence of localization and digitalization. Enterprises aiming to capture the opportunities in this emerging market must prioritize payment solutions featuring real-time settlement, local bank accounts, and regulatory compliance. By continuously strengthening its local network infrastructure, Feimautong empowers businesses to efficiently integrate capital flow management with market expansion, positioning itself as an indispensable strategic partner for numerous companies going global.